I got a call from a client recently asking this question. As I told him, any type of improvement which is permanently attached to the land is included in the appraisal. For outbuildings this would include barns and butler type buildings.

I got a call from a client recently asking this question. As I told him, any type of improvement which is permanently attached to the land is included in the appraisal. For outbuildings this would include barns and butler type buildings.

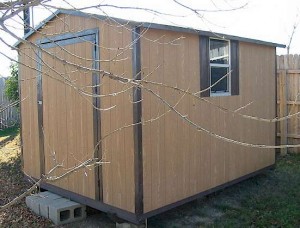

Some storage buildings which are smaller and are not on permanent foundations would not be included because they can be easily (relatively speaking) moved. These types of structures typically are just sitting on movable piers (such as concrete blocks). The same criteria would be used for above ground pools and hot tubs. They are considered personal property as opposed to real property. If you have any questions please call me at (205) 243-9304.

Some storage buildings which are smaller and are not on permanent foundations would not be included because they can be easily (relatively speaking) moved. These types of structures typically are just sitting on movable piers (such as concrete blocks). The same criteria would be used for above ground pools and hot tubs. They are considered personal property as opposed to real property. If you have any questions please call me at (205) 243-9304.

Tom, great article. It’s good to hear whether adding an outdoor structure like a barn would increase the value of your property.

Thanks Kristle. It all depends on the type of foundation and construction.

Tom, this is excellent advice for locals to read and learn. This is such a confusing and frustrating issue for them, especially when they invest thousands to ten of thousands of hard-earned dollars into these outbuildings and don’t understand why the market doesn’t reward them dollar-for-dollar. Great Post and Topic! Looking forward to reading more! Bill Cobb

That is so true. I always tell them to be careful of the cost, because you don’t always get it back.

Tom, great blog post. I am asked this all the time as well. I have thought about adding a definition in my appraisal addendum to address outbuildings with and without a permanent foundation.

That sounds like a great idea. It would probably reduce the calls about this sometimes confusing topic.

Once again Tom, thank you for the informative post.

Valerie Springer

Sr Residential Loan Officer

205-995-7283 x 304

Sure thing Valerie. Anything to help educate about the appraisal process.