Has There Been a Shift In The Real Estate Market?

From all indications, there has been a definite shift in the real estate market. The recent increase in interest rates has injected another variable into the market that participants are reacting to.

I like to get multiple perspectives on what is happening and in order to do that I review stats from multiple sources such as the Greater Alabama MLS, Redfin, and Altos Research to name a few. A lot of time the actual numbers from these sources may vary slightly, however, the general market trends do correlate well with each other.

Some of the key stats I like to consider to get a read on the market include the number of active listings, trends in price reductions, pending sales, days on market, and months (or weeks) of housing supply. It’s never a good idea to look at only one statistic as it could be misleading so I like to get an overall picture of what is happening and the best way to do that is to look at the market from multiple perspectives.

Today I’m going to look at the trend in the first six months of 2022 and compare that to the two prior years. This will show us how the market was affected by COVID and how the market is doing approximately 27 months after we went into lockdown.

5 Real Estate Stats To Keep An Eye On

1) Active Listings – Active listings in both Jefferson and Shelby County have increased since February. While there is some historical support for an upward trend, it appears this trend is larger than normal.

some historical support for an upward trend, it appears this trend is larger than normal.

There are several reasons that this could occur. The first is that sales could be slowing down while new listings continue to enter the market. The net effect would be an increase in the listing count.

The second reason could be that sales are continuing at a normal rate and there is an abnormal spike in new listings. Data from Altos Research seems to indicate a combination of both factors.

Within the past 4-6 weeks there has been both an increase in the number of listings and a decrease in sales. Given that this is the home buying season the numbers tend to suggest that recent home sales have been suppressed. This is most likely caused by the increase in interest rates.

2) Price Reductions – A change in price reductions can provide support for a shift in the market as well. From 2019 to 2021 the percent of Active Listings in Jefferson County with price drops had decreased, however, in mid-April of this year, the trend has continued to rise and has surpassed the past 4 years to 4.4%, compared to the low last year of 2.5%. The trend ins Shelby county is similar.

2021 the percent of Active Listings in Jefferson County with price drops had decreased, however, in mid-April of this year, the trend has continued to rise and has surpassed the past 4 years to 4.4%, compared to the low last year of 2.5%. The trend ins Shelby county is similar.

This is yet another indication of a shifting market. Sellers have had the upper hand over the past several years and have not had to even think about lowering the price of their homes.

A decreased pool of potential buyers due to higher interest rates has resulted in less competition. Some sellers may have priced their homes based on the past six months of market frenzy, however, they are now realizing that we are now in a different market.

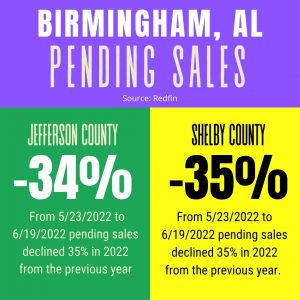

3) Pending Sales – The current number of pending sales is an early look at what the closed number of sales will look like in the coming month(s). It is a good snapshot of current market activity.

what the closed number of sales will look like in the coming month(s). It is a good snapshot of current market activity.

Historical figures indicate a steady to increasing number for this statistic, however, we are not seeing that trend in 2022. Within the past week, pending sales in Shelby County plunged to the lowest in the past 3 years after seeing an upward trend in the first quarter. Again, the trend for Jefferson County is similar.

4) Days on Market – We are still seeing a declining number of days on market from list date to sale date. While some areas of the market are shifting, there is still an imbalance in supply and demand.

market from list date to sale date. While some areas of the market are shifting, there is still an imbalance in supply and demand.

The lower days on market reflect the speed at which the available inventory is being purchased. Don’t expect this stat to change too much unless we see big changes in supply, which I discuss below.

5) Months of Supply – Beginning in 2020 we have seen lower months of inventory each year and 2022 is no exception. What we have seen over the past several weeks is an upward trend.

the past several weeks is an upward trend.

Over the past several weeks the months of supply have matched that of 2021. This is different than the prior three years when supply was significantly lower than the year before.

Again, this is significant because the housing inventory is starting to build back up which may give buyers more options when shopping for a house. Sellers will want to take this into consideration in their pricing strategy because of more competition.

Conclusion

With all that I have reported here please don’t think that the real estate market is tanking. We have seen unprecedented increases in sales prices due to supply and demand dynamics, however, we have to realize that things have changed and we may not be in the same market we were 6, 12, or 18 months ago.

Just as a football coach must change his play calling based on how the other team has lined up, sellers must changed their game plan on pricing based on what is currently happening in the market.

The recent increase in interest rates has affected potential buyers. Because they were increased this has taken some buyers out of the market because they cannot afford the higher payments.

With fewer buyers, there is decreased competition for the available inventory and this has resulted in buyers needing to readjust their list price. My best advice is to price to the current market and not to what was happening 3 months ago because if you do the appraisal may come out lower than the contract price which was arrived at using old sales data.

Question

Do you have any questions about the local real estate market? If I can answer any appraisal questions for you do not hesitate to contact me and as always thanks for reading.

Good analysis Tom. Thanks 🙂

Thanks, Albert.

Wow, your supply is so much higher than my market. It’s funny how that works in different parts of the country. We would 100% be declining if we had 4-5 months of supply. We are just above 1.7 months and the market is losing temperature. Great stats, Tom. I think the pendings are a particularly powerful indicator.

Thanks, Ryan. Yeah, it is very interesting to see what is happening in other areas. I’ve noticed how low you inventory is in past posts and that really explains why the market is the way it is in your area. Ours is definitely not as low as yours.