So what’s the big deal if the square footage in MLS is wrong?

Have you heard the new buzz word(s) these day? I’m sure there are many, but the one I am talking about is “Big Data”. In the appraisal world we have access to more data and computing power than ever before, and we have the potential to use that data to make our jobs easier and more accurate.

Have you heard the new buzz word(s) these day? I’m sure there are many, but the one I am talking about is “Big Data”. In the appraisal world we have access to more data and computing power than ever before, and we have the potential to use that data to make our jobs easier and more accurate.

Fannie Mae recently implemented the new Collateral Underwriter (CU) to be used in the underwriting of appraisals that are ordered by banks for mortgage loans. The CU will be used to measure the accuracy of data in appraisals and the reasonableness of the adjustments that appraisers put in their reports. If you’re wondering where I’m going with this, and what it has to do with whether the square footage in the MLS is wrong, stay with me and I’ll try to explain how it all relates.

Supporting adjustments

I recently completed an appraisal course aimed at helping appraisers use Microsoft Excel to support the adjustments they make in their reports. For those who may be unfamiliar with the appraisal process, appraisers develop and opinion of value for a property they are appraising by locating recent sales (comps) to compare to their subject property. In a perfect world the appraiser would like to find three sales of identical home to use in the appraisal, and since they are identical there would be no need for the appraiser to make adjustments because the square footage, bedrooms and bathrooms, and all the features would be the same. But since the world is not perfect, and there are variations between homes, the appraiser must determine what value related differences exist between the properties so that they can make adjustments to each sale in order to arrive at an adjusted value for each comparable. It is from this adjusted value range that the appraiser can then reconcile their final opinion of value.

The big challenge

The big challenge for appraisers is collecting enough reliable sales data in order to come up with the adjustments they make in their reports. Excel, or any other good spreadsheet program, can sift through the large amounts of data available to help the appraiser calculate these adjustments and support them should they be asked to by loan underwriters.

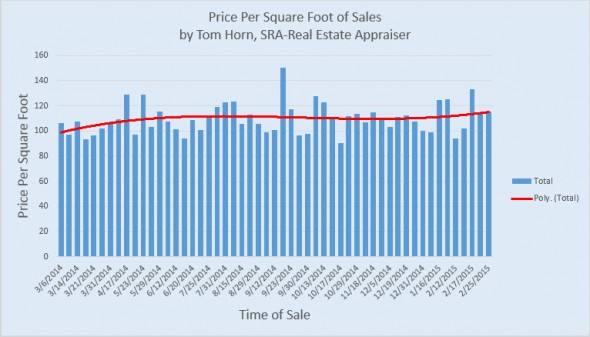

These programs can use multiple regression and statistical analysis to come up with adjustments IF they have reliable data to work with. Having correct square footage and accurate price per square foot provides a way to measure property value trends as well as price differentials for different features, and that is why it is important that MLS listings have accurate square footage. The contributory value of a specific feature can be identified by looking at differences in what properties sold for on a price per square foot basis. Take a look at the price per square foot of sales graph to see what is possible when you have accurate square footage information to work with. This is actually a simple graph that measures what the average price per square foot is on a monthly basis. We can also compare price per square foot differences between a large population of data to see what impact a certain feature has. By isolating the difference between the two we can support an adjustment for that feature. I always get questions like “how much value does a pool (or some other feature) add”. The type of analysis I am explaining here actually helps appraisers determine how much value a pool will add, or any other feature. Or, it might even tell us that a feature adds no contributory value.

reliable data to work with. Having correct square footage and accurate price per square foot provides a way to measure property value trends as well as price differentials for different features, and that is why it is important that MLS listings have accurate square footage. The contributory value of a specific feature can be identified by looking at differences in what properties sold for on a price per square foot basis. Take a look at the price per square foot of sales graph to see what is possible when you have accurate square footage information to work with. This is actually a simple graph that measures what the average price per square foot is on a monthly basis. We can also compare price per square foot differences between a large population of data to see what impact a certain feature has. By isolating the difference between the two we can support an adjustment for that feature. I always get questions like “how much value does a pool (or some other feature) add”. The type of analysis I am explaining here actually helps appraisers determine how much value a pool will add, or any other feature. Or, it might even tell us that a feature adds no contributory value.

Accurate square footage in MLS is critical

With the exception of gross living area I find that most of the data included in the MLS is accurate, however as the title of this post indicates, it is very important for the gross living area to be accurate because it plays such a big role in the appraisal process. In the Birmingham, AL area the MLS offers several sources for agents to get accurate square footage, including tax records, builder plans, or from an appraiser who has personally measured the home.

The only source that agents use that I still see as a problem is county records. When using county records the most accurate figures are for one story homes on a crawlspace or slab. I find the least correct estimates are for homes with half stories and finished basements. I caution agents against using county records for square footage information on these types of houses whenever possible, however if they choose to use it they should test for reasonableness before using that information on the MLS form. One example I am aware of that I ran across recently was for a 1.5 story home. The MLS form indicated that the second story had more area than the first level even though it was only a half story and obviously had less area than the first. If you see something like this you may want to see if an old appraisal exists to get information off of it or have an appraiser measure the house for you.

What’s in it for the agent?

In addition to decreasing their liability for quoting wrong information, agents have a lot to gain from including accurate square footage in their listing sheets. The first is that they will be able to price their listings more accurately if they know the correct square footage. If you over price a home because you think it is 500 square feet bigger than what it really is the home may not appraise.

The second reason is that market reports provided by the MLS will be far more accurate when doing CMA’s and BPO’s because the information they use will be correct, and this will help you price your listings better. This will reduce the likelihood of the home not appraising on the back end of the transaction.

The last reason is that the agent, by providing the best information possible, will be helping appraisers do their best job. This will allow appraisers to harness the power of big data, to sift through it using Excel or other spreadsheet programs, and to produce a more solid appraisal. This is a win-win for both parties and it contributes to a better product for the consumer.

Question

Do you think it is important for the MLS to show correct square footage. If you are an agent what are you doing to provide the most accurate data possible? Thanks for reading and please leave a comment below if you’d like to join the conversation.

If you liked this post subscribe by email (or RSS feed). Thanks for visiting.

Real estate agents have legal and ethical obligations to their clients. Properly recording GLA square footage aligns with these responsibilities, as it represents an accurate and complete representation of the property. Real estate agents are known to add a few extra sq ft.

You are correct that accurate GLA square footage is the responsibility of the agent, however, I don’t think all agents take this seriously. I have seen many MLS listings that have grossly inaccurate GLA, however, there does not seem to be any serious repercussions for including the inaccurate data. This inaccurate data data is carried forward to the data statistics that the MLS publishes which can negatively impact CMA’s that agents produce to price their listings.

Well right now I’m pissed! We live in AZ and last year purchased a manufactured home with sqft over 2000. This year due to the interest rate dropping we decided to refinance. Our home came back at 1300 sqft due to an addition that didn’t have heat/cooling. today we were told that the addition was never permitted. Thoughts?

It might be possible to have the local inspector look at the addition to see if it can be approved. Of course, you may need to tweak the work that has been done to get it to meet code if it does not. In addition, if you add heating and cooling then most likely it can be counted with the rest of the living area.

I like how Gary said “accurate data is the foundation” in the comments. Great points in this post, Tom. Square footage is one of the primary factors buyers use when shopping for a home, so it’s really important to get the right data entered into county records. Accurate information can certainly decrease liability for agents, but it’s definitely helpful for the sake of comparison for appraisers. It sounds like Tax Records is much less accurate in your area, but even in my own, there are definitely times when the property is simply much different that what Tax Records states. For instance, I appraised a house a few weeks back that was a 3-bed/2-bath instead of a 2-bed/1-bath as Tax Records indicated. The addition was permitted, but it was not recorded.

It depends on the type of house whether the tax records is correct. I was reminded of the importance of MLS data having correct square footage during my recent excel class. Hopefully agents will see how everyone stands to benefit with correct info.

I appreciate your blogging and I have learned allot and you get me thinking.

I have seen many confusing figures all over the place. Trouble with all this information that is available. garbage in , garbage out. Somehow the “out” get to be the law, right or wrong, and heavily used, abused.

I am an agent in Florida and sat in a seminar, (Florida agent) where square footage is heavily look at for “value”. I have never felt comfortable using this criteria. Also, I was shocked to been told, in this seminar, appraisers ” do not use this in their value”. I still have not been able to confirm this statement with other sources. I am under the impression, all look at the county appraisals records for square footage, and lot sizes information. Maybe why i have never seen any or know of any reports of discrepancies in measurements since all use the same “bible” Lastly, there are faults in CMA. Pending properties, never get updated to what the present contract was made for in price. It stays whatever it was, before there was a contact on the properties. So that Pending price is a mystery. I concluded CMA are done using 6 listed and 3 sold properties. Pending are mysteries, and MLS rules have to change to make them useful in determining pricing, because as I see it, these are live market value in any market conditions. Hope I made sense. I been struggling real time, with what your blog is about and caught my attention. MLS has one measurement, appraisal office another, and a past sold MLS on this property that differ from county records.

Thanks for commenting Ronald. I agree with you about the “garbage in-garbage out” scenario. If an agents listing price or an appraisers value is based on incorrect information this is not good for anyone. Appraisers do consider the square footage of a house because we have to make adjustments for differences between the house we are appraising and the comps. Using price per square foot to price a house is not a good idea except for special situations. Agents should know when they need to get a professional to measure their listing. I wrote a previous post and included an infographic about how to do this. Pending sales are very important to appraisers because they provide current data on what similar properties are selling for. I am able to get the pending price sometime but when I am not I apply a sale price to list price ratio to get an estimate. Thanks again Ronald for bringing up these valid concerns.

Yes, it is very important for the MLS to show correct information. Accurate data is the foundation of a strong market. It allows buyers and sellers to make the right decisions and it allows appraisers and others to monitor and measure the market accurately.

Real estate agents in our area have not had to put in square footage for many years, however this chanted last year when it became a requirement. Even now the information is not the best because, as I said in the post, some agents use the county records info whether it is accurate or not. This makes the appraisers job very difficult when they are trying to use modern statistical methods to measure the market. Hopefully this will change as agents become more aware of the importance of accurate information.