Today I thought I would take a look at one of the key elements in assessing the health of the Birmingham, AL real estate market. There are different key indicators including number of sales, change in mean and average sales price, and number of active listings (inventory) to name a few, but today I decided to look at distressed sales, ie: short sales and foreclosures. In a future post I will look at some of the other statistics.

Today I thought I would take a look at one of the key elements in assessing the health of the Birmingham, AL real estate market. There are different key indicators including number of sales, change in mean and average sales price, and number of active listings (inventory) to name a few, but today I decided to look at distressed sales, ie: short sales and foreclosures. In a future post I will look at some of the other statistics.

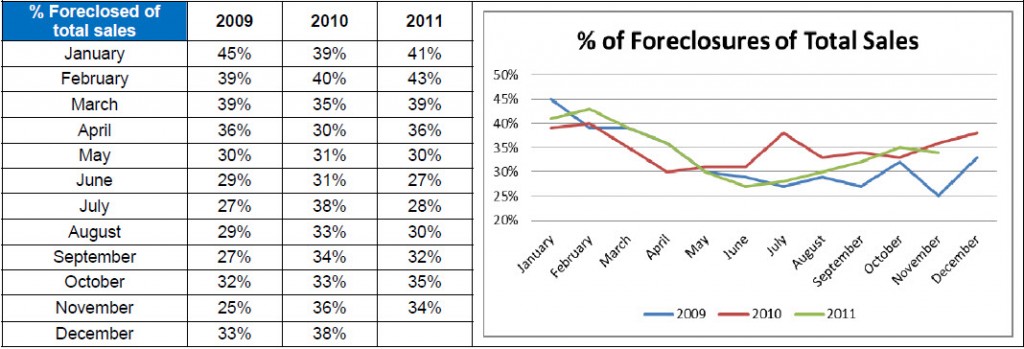

Distressed sales, which include foreclosures and short sales, have had a tremendous impact on property values not only in the Birmingham, AL market, but the entire nation. As I have noted before, our area has not been as hard hit as others. These types of sales have not only caused the average and median sales price to decrease from a statistical perspective but they have also affected the actual sales price of “normal” sales in the market. Due to the sheer number of these types of sales, and the necessity of using them in market value appraisals, they have had a detrimental affect on the sales price of non distressed properties. Take a look at the statistical data provided by the Birmingham, AL Multiple Listing Service.

Since January of 2009 distressed sales have accounted anywhere from 25% to 45% of total sales. The trend from 2009 to 2011 has generally been similar for each year, and reflect normal month to month fluctuations in overall sales, however in 2010 there was an unusual spike in percentage of foreclosure sales in July at the rate of 38% of total sales. This could have been some kind of carry over from the first-time home buyer tax credit or a release of some shadow inventory. Generally speaking though, the percentage of foreclosure sales declined from January of 2009 when it was 45% and has leveled out (not considering typical fluctuations) at between 30-35%. While this is not as bad as other areas of the country it does take its toll on the local Birmingham market. Until the number of foreclosures decrease significantly they will continue to negatively affect the non-distressed sales because they provide competition to them. This is only the case for the foreclosures that are in similar condition and appeal to non-foreclosure homes. What do you think about the figures from the table?

If you have any real estate appraisal related questions you can call me at 205.243.9304, email me, or connect with me on Facebook., Twitter, or Youtube.

Are these all sales to residential buyers that will live in them or does this include sales to investors that buy, fix up and sell them to those end buyers?

The data from the Birmingham MLS does not make a distiction between the homes that are purchased by owner/occupants or investors. It is assumed that they are all included together.

It’s good to hear the foreclosure rate has seen a decrease. It’ll be nice when things get back to “normal” again – though that just seems so far away.

It does seem like it might take longer than our patience, thanks for sharing your insights. I know you guys have higher foreclosure numbers than us, and are experiencing greater depreciation. Good luck in your area.