Are you curious about the Jefferson County zip codes with the highest sales prices?

As a Birmingham appraiser, our job is to know what is going on in our market which includes keeping up with property values and real estate trends. I thought it would be interesting to know the Jefferson County zip codes with the highest sales prices.

In today’s post, I’ll share with you some of my market research about where the most expensive homes in Jefferson county are. As an appraiser (and as a homeowner), it helps to know what factors influence prices so before we get to the top Jefferson county zip codes with the highest property values lets look at what these factors are.

Keep in mind that the factors that influence prices also help property appreciation. While you may pay more for a home in these neighborhoods your home will typically appreciate in value more so than other areas.

Factors That Affect Property Values

Location- You’ve heard the old saying about location, location, location, right? Well, it’s true. You can take a house in one location and move it to another and it could double in price just because of where it is at. Of course, location is also dependent on some other factors on my list as well.

School Systems- School systems are one of the biggest factors that drive property values in the Birmingham, AL area. I’m sure this is true for where you live as well.

Parents want to know that their children are getting a good education. This can translate into higher test scores which will also contribute to higher ACT and SAT scores when they are choosing a college

Some home buyers weigh the cost of a more expensive home with what they would pay for private school tuition. If they buy a home in a reputable school system they may not have to pay out money for a private school and this could end up saving them money over the long haul.

Access to Work Areas- Easy access to areas of employment can definitely influence what someone is willing to pay for a home. Extended travel time and fuel costs can cut into your take home pay, so buyers may be willing to pay a little more for a home that is close to well-established work areas.

The Value of Other Homes- It’s a simple fact that if you buy in an area where there are higher-priced homes this will help the value of yours as well. The historical price of homes in an area also affects what buyers are willing to pay.

Unless there are extenuating circumstances related to economic factors home prices typically appreciate. If other similar homes in your area have gone up over the last several years then that is a good indication that your home’s value will also increase.

Neighborhood Support Services- Being close to shopping and other support services such as banks, recreational facilities, and entertainment districts can also have a positive effect on the value of a home.

Birmingham is a prime example of this. Over the last several years the downtown area of Birmingham has done a very good job of revitalizing the city. This has resulted in more restaurants and entertainment venues such as the Uptown District and Top Golf in Birmingham.

As a direct result of this home prices in adjacent areas have started to increase. With more of the support services, buyers are more interested in moving to these areas which affect supply and demand and home prices.

Safety/Crime Rates- Of course we all know that if buyers have their choice they would not want to be in areas where safety is a concern or crime rates are high. Typically, homes in areas with lower crime rates tend to sell for more.

There are websites where you can check out the amount of crime in different areas. Doing this before you purchase a home can give you peace of mind that this particular factor will not be detrimental to your property value.

A Look At The Numbers

So now that we’ve looked at the factors that affect property value let’s take a look at those areas in Jefferson County that have had the highest home prices over the last 12 months.

I searched the Greater Alabama MLS from September 1, 2018, to September 30, 2019, to find out which zip codes and areas have the highest average sold price and here is the result:

Some of these zip codes are in the same general area. For example, the two zip codes with the highest average sale price are both in the town of Mountain Brook.

Some of these zip codes are in the same general area. For example, the two zip codes with the highest average sale price are both in the town of Mountain Brook.

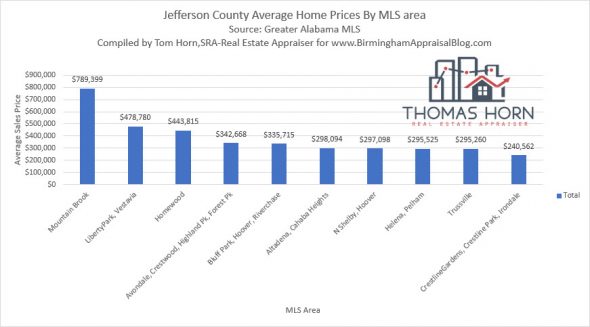

To get a better idea of where the highest sales prices are the following chart breaks it down by MLS area:

As I also noted, school systems play a big part in property values. A recent survey of the top schools in Alabama named the following area schools as best in the state.

- Mountain Brook- #2

- Spain Park- #4

- Homewood- #6

- Hoover- #7

- Vestavia- #8

- Oak Mountain- #11

Here is a breakdown of the average sales price by school system:

As you can see, many of these schools are among those in the top 10.

Questions?

I hope this information has been helpful to you. If you have any questions feel free to leave a comment below or you can email or call me.

If you are selling in any of these areas and would like to know what your home is worth a pre-listing appraisal can help you price your home accurately so that you don’t leave any money on the table. As always, thanks for reading.

Cool graphs Tom. I like how you’ve broken things out by school as well as zip code. I’ll have to try that one of these days. Did you segment by zip code based on MLS data? Or did you have to draw boundaries on an MLS map maybe?

Thanks, Ryan. I started off by segmenting the data by zip code but in some areas, the zip codes cover a wide geographic area. I thought it might be more meaningful to do it by MLS area because they seemed to give a better idea of where the higher-priced homes were. I then looked at prices by school system to give a little more insight into how the top-rated school systems measured up when it came home prices. It was very interesting to see how it all is interdependent.