Where Is The Birmingham Real Estate Market Headed?

Just when you think the Birmingham real estate market can’t get any higher, it does. When I say high, I’m not only talking about sale prices but the number of offers as well.

Even though it’s not the highest price ever paid in this area, there was a home that sold for $5,000,000 in January of this year, which puts it in the top three over the past 14 years. It was in the Mountain Brook area, which makes sense if you are familiar with the Birmingham market. Mountain Brook has some of the highest-priced homes in the state of Alabama.

Prices are not only going through the roof but the number of offers is too. I recently saw on Facebook that one Birmingham area house received 58 offers.

This may be common in other markets across the country but it is rare in the Birmingham area until now. This market has started to see this type of over-the-top market behavior recently.

When prices are driven higher than the list price, and contracts are written based on these offers, there is always the chance that the appraisal will be lower than the contract price. Contracts now have “appraisal gap” coverage that guarantees that the buyer will make up the difference between the appraised value and the contract price. Bill Gassett wrote a very good article recently titled “What is an Appraisal Gap Coverage Clause” that describes exactly what it is. I highly recommend reading it to know what options are available.

Low-Interest Rate Fuel

As I noted in my post last week, this hyper-activity is being brought on by a very low inventory of homes and an increased number of buyers due to the low-interest rates since the beginning of Covid.

The recent increase in interest rates, as well as the subsequent increases planned throughout the year, may have a cooling effect on the demand side of the housing market but we’ll have to wait and see as the year progresses.

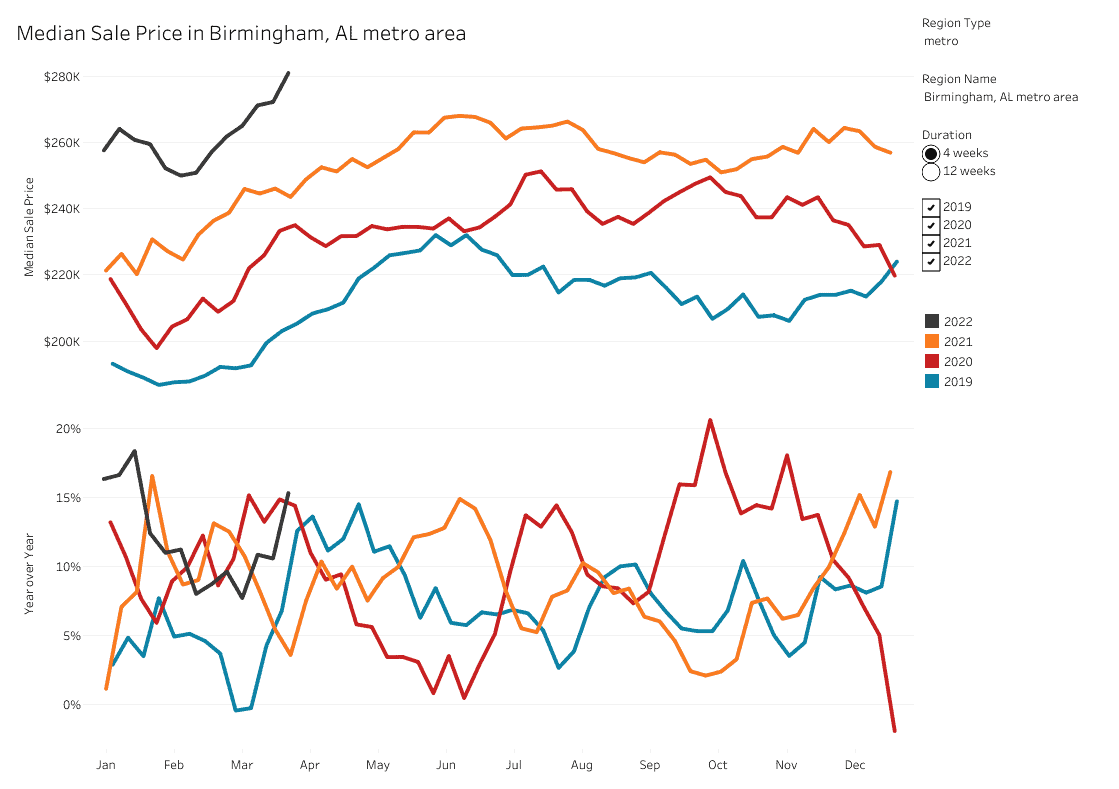

As of the end of February 2022, the median sale price in the Birmingham area is already at a high of $281,000. This also far exceeds the past three years and there does not appear to be an end in sight.

Given how we are at the top of the market (for now) I thought it would be interesting to compare how much house you would get currently for $300,000 (rounding the median price up) compared to three years ago before the pandemic sent the real estate market into hyperdrive. The chart below compares median prices from 2019 to 2022:

Besides the median sales price being up approximately $95,000 between 2019 and 2022, the Greater Alabama MLS shows that the average gross living area across the Birmingham metro area for a $300,000 home in 2019 was approximately 300 square feet larger than it is now.

Here are some takeaways when comparing 2019 to 2022:

- Financing for both time periods was predominantly conventional loans

- The median days on market in February 2019 was 37 compared to 7 in 2022

- The sale price to list price ratio was 1% higher in 2022

- Average days on market went from 60 to 27, for a reduction of 55%

- Cash sales accounted for 33% more sales in 2022 than in 2019

In other news, companies like Opendoor are buying more homes for way over the list price. Is this a strategy to pump up comp prices? Who knows?

If these are one-off sales they won’t have much of an effect, however, if more inflated prices follow it could start a trend. The job of the appraiser is to research these sales and determine if the sales are outliers or if they truly represent what is going on.

Here is a recent video of someone describing how this is happening in their area.

https://www.instagram.com/reel/CWbKbhkFhsF/?utm_source=ig_web_copy_link

I recently ran across a similar sale in the Birmingham real estate market. A property was purchased by Opendoor and shortly thereafter it was put on the market for sale again at a much higher price with little to no improvements (based on MLS photos). These types of sales are dirtying the data that agents and appraisers are using to price and appraise homes.

What long-term effect will this have on the real estate market? By the time we find out it may be too late.

Question

The Birmingham real estate market is breaking records every single day. How long it will last is anyone’s guess. If you have questions about the local market or need an appraisal please give me a call and as always thanks for reading.

Interesting to hear, Tom. I see Opendoor sales all over the place. Sometimes they sell for less, sometimes more… It just depends. I find the improvements are bare bones overall. What do comps suggest for value though? That’s always the question.

So far I have only seen Opendoor resales that are quite a bit higher than the prior sale and they appear to be outliers on the high end of the range. I agree with you that the improvements are bare bones.