Don’t Let the Condition of your Home be the Reason for a Low Appraisal

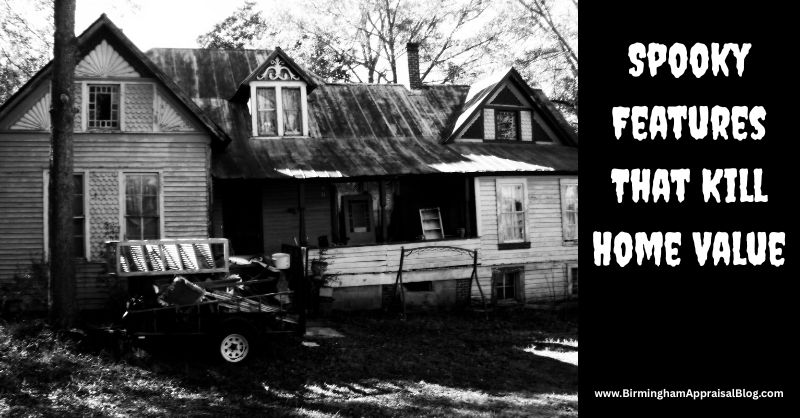

After 35 years as an appraiser, I think I’ve seen everything when it comes to spooky features that can scare away a buyer or lower its value. Some properties have been well maintained, while others make me afraid to step inside. With Halloween coming up, I thought I would discuss the kinds of “spooky” features I encounter on appraisals. Not cobwebs and creaking doors, although I’ve had my share of cobwebs in the face, but the real issues that kill the value of your home and create issues for buyers, sellers, and lenders.

Even if you’re not planning on moving soon, knowing what might impact your home’s value can save a lot of headaches and money down the road. Here’s what I look for and why it pays to address these things before they become a problem.

Deferred Maintenance and Poor Condition

It doesn’t take an expert to spot signs of neglect. Peeling paint, curled shingles, and water stains stand out. But what you might not realize is just how much deferred maintenance works against the value of a home. I remember walking into a property where a long-term roof leak had gone undetected in a back closet. At first, it seemed like a minor stain, but digging deeper revealed rot and water damage that required expensive repairs.

From an appraisal perspective, homes with obvious deferred maintenance usually require the appraiser to either search for comparables in similar condition (which often lowers the value by reflecting the condition of the property) or make significant downward adjustments compared to sales of well maintained homes. Either way, the result is the same: less value for the seller, more risk for the buyer. If the appraisal is for a refinance, this means the owner will not be able to get as much equity out of their home because the appraisal value is lower.

It’s especially important to address these items if you’re thinking about FHA financing. FHA appraisals tend to be more strict than conventional loans because they require the home to meet certain minimum property standards. If there’s peeling paint, damaged steps, or a faulty heater, those issues will need to be fixed before the loan gets approved. Being proactive saves time and avoids last minute surprises.

It’s best to address routine repairs and upkeep when you become aware of them. By taking a careful look around your home and tackling the repairs when they’re small, you will prevent them from becoming bigger issues in the future.

Structural Concerns

Cracks in the foundation, floors that slope, and windows that don’t close aren’t just scary because they look bad. They can indicate more serious problems that affect the safety and usability of a home. I’ve been on appraisal inspections where what appeared to be a minor uneven floor turned out to be a more serious problem.

If these concerns show up, buyers may question the condition of the whole house, and lenders may not go through with the loan until the problem is addressed. When it comes to value, properties with structural issues, especially if there are recent sales of similar homes in poor shape, tend to set a lower bar for the whole neighborhood. If there are no sales of homes in similar condition, it will be necessary to take into account the cost to repair and make a downward adjustment to sales that are in better condition.

Having an inspector or contractor look for possible issues before you list your home can also be very helpful.

Evidence of Water Damage or Mold

One of the top negative condition issues in a house is mold due to the potential health issues. Water stains and musty odors usually indicate ongoing leaks or moisture problems. Sometimes these are hidden inside walls, under flooring, or in basement corners where they’re easy to miss.

Aside from health risks, untreated moisture problems can weaken a house’s structural stability. On appraisals, we have to note any visible mold or related damage, and again, the sale may be held up if you’re using Conventional or FHA financing. Addressing leaks early and hiring a professional to remediate mold is important. If I notice these problems, I’ll look for “comps” with similar conditions or deduct estimated repair costs from the home’s value.

Buyers are becoming more and more sensitive to these issues, so making sure your home is dry and free from mold is an investment, especially before an appraisal.

Outdated or Non-Functional Systems

Most buyers expect systems like heating, cooling, plumbing, and electrical to be functional and safe. On every appraisal, I pay close attention to the age and condition of these components.

If you haven’t kept up with maintenance and replacements, you might run into trouble not only with buyers but also with lenders. For FHA appraisals, we are required to check for properly working heating systems. Homes with updated, well-maintained systems are easier to sell, demonstrate pride of ownership, and rarely present problems with financing or value.

If you’re unsure, consider having these systems serviced before your appraisal.

Pest Infestation

No one likes surprise guests, especially termites. I’ve seen homes that looked great on the surface, but when it was looked at more closely, showed more serious signs of termite or rodent damage.

In addition to being a hassle, pests can cause serious structural damage. If there are recent sales of homes with similar problems, they will be used as comps because they will reflect a property in similar condition. If there are no sales that have similar damage, it will be necessary to consider the cost to repair and adjust the value accordingly.

Regular pest inspections help protect your home and ensure there are no appraisal issues.

Functional Obsolescence

Sometimes homeowners make changes to their homes based on what they want, but the changes don’t always translate well to resale value. I appraised a home once where the property was built as a three bedroom home, like most in the neighborhood. The owner, who lived alone, combined two bedrooms into one large owner’s suite and converted the third into a walk-in closet. The home now only had one bedroom, making it tough to compare with others in the area.

Functional obsolescence isn’t necessarily about poor condition; it’s about the property no longer meeting market expectations. When appraising a property like this, you can’t compare it to nearby three-bedroom homes, and buyers generally aren’t interested in a one-bedroom house when everything else nearby offers more functionality.

Before making major changes like this, think about how it will affect the property’s marketability if you ever need to sell.

Curb Appeal Neglect

It’s hard to overstate the importance of first impressions. Overgrown yards, chipping paint, broken fences, or clutter may give appraisers or buyers the wrong first impression when they’re looking at your home. I’ve seen homes where a little exterior cleaning and a fresh coat of paint made a huge difference in its curb appeal and how people viewed the home.

I always recommend to homeowners that they clean up the outside of their property before an appraisal is done. It helps set the tone for the rest of the appraisal inspection.

The Impact on Value

All these “spooky” features add up. If your home has visible problems, it will be necessary to look for recent sales of homes in similar condition for comparables. If those sales are lower, your home’s value will likely be too. Otherwise, the repair costs will need to be estimated and a downward adjustment made to the comparables that don’t have these issues.

Homes that meet FHA standards and don’t have deferred maintenance are usually easier to sell, finance, and appraise. Taking care of these issues before listing your property helps you avoid having to do these things after the appraisal, which can increase costs and potentially delay the closing.

Advice for Sellers and Homeowners

Every now and then, do a quick walk-through of your home and notice what stands out—what you love and what might need a little work. Handle any safety or functional issues first. It’s not glamorous, but regular maintenance is what keeps your home in good condition and your investment safe.

If you are thinking of refinancing or listing your home, it’s a good idea to schedule basic repairs and inspections ahead of time, especially if there’s any chance your buyer will use FHA financing. Not only will this make your life easier, but it will support your home’s value in the end.

Share Your Experience

If you’re an agent, homeowner, or appraiser, I’d love to hear your stories. Have you had a scary situation where deferred maintenance or unusual changes threatened to kill the home’s value? Do you have questions about what impacts value most, or how to prepare for an appraisal? Share your experiences or questions in the comments below.

Conclusion

Whether or not you’re thinking about selling, keeping your home free from the “spooky” features I’ve described here pays off. If you have questions about what might impact value, what FHA looks for, or anything else appraisal related, reach out any time, and as always, thanks for reading.

Buyers today are so picky about condition too. I’ve found in recent years (at least in my area), that there is a hypersensitivity toward condition, price, and location.

I agree, Ryan. I think as housing inventories slowly start to rise and buyers have more of a choice they tend to become more picky with the condition because they have more choices. During COVID where there was more of a shortage, buyers were less concerned with the condition of the property.