Some Things Appraisers Notice May Surprise You

The appraiser arrives at your house and introduces themselves. He or she tells you they will start on the outside of your home by taking some measurements and then look at the inside.

During this process, which can take anywhere from 30 minutes to several hours depending on the size of the home, you will see them moving from one room to another. They will be taking notes either with a clipboard or tablet all the while observing your home.

In addition, they will be taking photos of each room in the home along with items they believe to be critical to determining the value of your home. So what exactly does the appraiser consider when they are wandering through your house?

In this post, I am going to share with you 8 interesting things appraisers notice during their observation of your home. I hope this will help you understand what factors are considered in an appraisal and in turn help you to prepare for the appraisal inspection.

1) Quality of construction – During the property observation, the appraiser will notice different quality factors about your home. Some of these include the materials that are used such as hardwood floors, quartz counters, crown molding, or the number of plumbing fixtures in the bathrooms.

These items vary in homes depending on the quality of construction. Lower quality homes may only have painted walls, laminate counters, vinyl flooring, and minimal plumbing fixtures whereas those of higher quality will have the aforementioned finishes and features.

Observing these features of a home helps the appraiser to rate the quality in order to accurately develop a replacement cost for the home and for comparison to the sales used in the report. It is always better to use sales of similar quality rather than ones that are either superior or inferior and then make adjustments since this type of adjustment can be somewhat subjective.

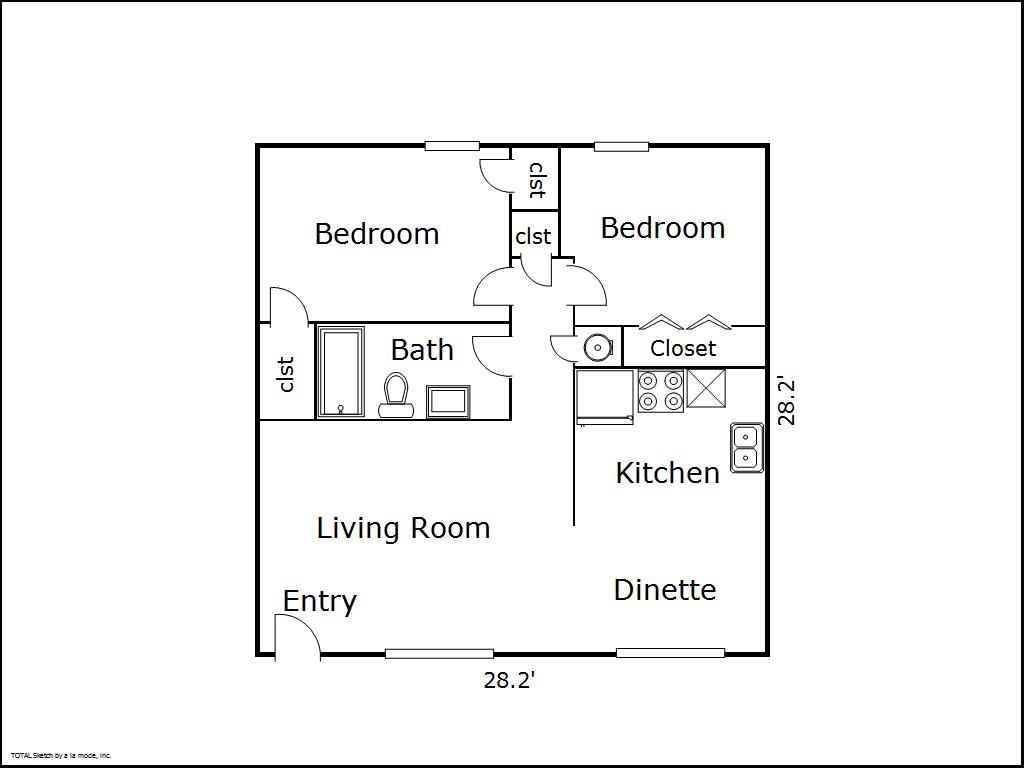

2) Floor plan layout – In addition to sketching and measuring your house to calculate the square footage, the appraiser uses the drawing to show the location of every room in the house. This helps readers of the report visualize the layout of the home.

show the location of every room in the house. This helps readers of the report visualize the layout of the home.

The appraiser can also illustrate any functional obsolescence the house may have. I wrote an entire blog post about this so I won’t go into super detail here but will instead let you read that article to find out more about how it can affect value.

While we are walking through your home we are looking at it through the eyes of a typical homebuyer. This can help us to identify possible floor plan flaws that may have a negative impact on value.

3) Needed repairs – Appraisers are trained to observe every little thing about your house. This includes what appraisers call deferred maintenance.

This is a fancy phrase for items that need repair. These can include cosmetic repairs as well as others that may affect more long-lived items of construction like the roof, electrical, or plumbing system to name a few.

While these things are important in all appraisals much more emphasis is placed on them being repaired prior to the loan closing for an FHA appraisal. To prevent delays in the loan process sellers should identify these repairs and complete them prior to the appraisal so that they do not hold up the process.

4) How it fits into the neighborhood – This is commonly referred to as the principle of conformity which states that value is created and maximized when a property conforms to its nearby surroundings.

surroundings.

One of the main reasons a bank wants an appraisal on a home they are using for collateral is that they want to know if it will be easy to sell should they need to foreclose on it. If they find out the home is oddly unique this may make it more difficult to sell which could result in them having it on their books longer and possibly losing money.

Haven’t we all seen the house that looks like a flying saucer? Can you imagine trying to sell something so unique? While there may be some buyers that want this type of home they may be far and few in between which can result in the sale taking longer and possibly not covering the mortgage balance.

5) Water pressure (for FHA appraisals) – One of the many things that an appraiser looks at during an FHA appraisal inspection is the water pressure. This may not be an issue for newer homes but it could be for older ones.

pressure. This may not be an issue for newer homes but it could be for older ones.

According to the HUD Handbook which includes appraisal rules:

“The Appraiser must flush the toilets and operate a sample of faucets to check the water pressure and flow, to determine that the plumbing system is intact, that it does not emit foul odors, that faucets function appropriately, that both cold and hot water run, and that there is no readily observable evidence of leaks or structural damage under fixtures.”

Real estate agents should be familiar with these guidelines so that they can help their clients address these issues before the appraisal is done because if they are not taken care of there could be a delay in the loan closing process.

6) Water damage – Something that the appraiser is trained to notice is signs of water damage. A couple of places that we look at are ceilings and under sinks.

A water stain on the ceiling can be a sign of a faulty roof or if it is on the basement ceiling it could be a leaking plumbing fixture from the floor above.

I have been in some homes where a roof was replaced but the stain from a previous leak has not been fixed. Sometimes a loan can be held up because the seller did not remove the stain by something as simple as repainting over the area.

Again, I stress the importance of handling these minor issues beforehand to avoid potential issues that can hold up a loan.

A similar scenario can occur with water leaks underneath a sink. The leak should be fixed before the appraiser’s visit because the appraiser will check for this.

If a leak was repaired but the floor of the cabinet still shows signs of water damage it will be a repair requirement which, again, will unnecessarily delay a loan closing until the issue is resolved. These types of delays are not the appraiser’s fault because they are things that are easily taken care of before the appraisal is done.

7) Weird noises – Does your heating and cooling system make odd noises when it’s turned on? Does the bathroom exhaust fan sound like it’s on its last leg?

If so you can bet the appraiser will notice it and write it up in the appraisal, especially if it is for an FHA loan. If you are getting an FHA loan through HUD they want to make sure that everything is working properly and that the homeowner will not have any extra expenses in fixing things that need repair.

This helps ensure that their collateral is in goods shape and the buyer can make the payments because they do not have any unexpected expenses.

8) Peeling paint (for FHA appraisals) – Lastly, I want to discuss peeling paint because it has recently become an issue for conventional appraisals as well as those done for FHA/HUD. Prior to 1978 paint used in houses contained lead, which is poisonous if ingested.

appraisals as well as those done for FHA/HUD. Prior to 1978 paint used in houses contained lead, which is poisonous if ingested.

Because of the toxic nature of lead-based paint, FHA/HUD requires that any homes built prior to 1978 and that have peeling, chipping, or flaking paint have the paint removed and repainted. There are specific guidelines that should be followed regarding the removal of the paint from the property.

Recently I have seen lenders require peeling paint to be corrected for not only home built prior to 1978 but also for homes built since 1978. In addition, some banks are also requiring paint to be removed from homes that are being purchased with a conventional loan.

This appears to be a bank-mandated requirement so some may or may not require it. Just to be safe I would suggest that all peeling, chipping, or flaking paint is removed from the home before it is listed and before the appraiser visits the property.

Question?

Do you have any questions regarding what appraisers are looking for in your home during their visit? Leave a comment below if you do or if you have any other questions. As always, thanks for reading.

Great article! I don’t think most home sellers have any idea of the various things that come into play when assessing a home for value. It is so much more than just square footage. This article does a great job of pointing out some of the issues. If homeowners would be more proactive about repairs before listing their properties, and make a few updates, their homes would see better numbers at appraisal time.

Thanks, Shannon. I agree about the repairs too. One thing they should keep in mind is that a repair may only cost $100-200 but a buyer may overestimate it and say it costs $1,000 and lowball an offer. In addition, they may think that there could be even more repairs that are needed whereas if everything is repaired and in sellable condition, there may be less negotiating.

Interesting Tom. We appraisers are definitely paying attention. I will say I don’t often hear any weird noises with heat and air as I only do private work these days (so the system is not turned on). But I get it. This makes reasonable sense.

Yeah, it doesn’t happen much but I definitely listen closely for potential problems.