A Closer Look At Days On Market

Being an appraiser I often get asked off the cuff what I think someone’s house is worth. Appraising is much more than a guess at value, but that is exactly what people want when they ask this question.

Being an appraiser I often get asked off the cuff what I think someone’s house is worth. Appraising is much more than a guess at value, but that is exactly what people want when they ask this question.

Similar to when someone asks a mechanic what they think could be causing their car problems or a doctor about certain aches and pains without even being looked at it’s difficult for an appraiser to give an accurate estimate of value without digging deeper.

Developing a professional opinion of value involves studying the market and analyzing sales trends and metrics. Today I thought I would pick out one metric that appraisers look at and dig a little deeper to explain what it can tell us about the market and how it might affect how long it takes to sell your home and what price you sell it at. That metric is Days on Market or DOM.

What Is Days on Market?

The Days on Market (DOM) statistic is a measure of how long it takes to sell your home. It is measured from the day it is initially listed until it goes under contract.

Another related stat is Cumulative Days on Market (CDOM) which is similar to DOM with one important difference. It is a measurement of the total time a home is on the market. For example, if a home was listed for 60 days, taken off the market and then relisted again for 30 days before it goes under contract then the CDOM is 90 days.

It’s important to know the difference between the two so you get the true picture of how long it took to sell. A common practice if a home will not sell is to take it off the market and then quickly list it again so that the DOM resets and the listing looks less stale.

This is done because a home that has a long DOM may scare off potential buyers since the long DOM may make buyers think something is wrong with the home.

Days on market can vary for homes in different price ranges as well as location and time of year. What may be a typical DOM for one area may be long for another so it is important to compare apples to apples.

A large metro area may have a particular DOM while a subdivision within that market may have a much lower or higher DOM. Context is important and while a macro stat for the area can give us an idea of how well the larger market is performing it is important to drill down to the micro level to truly understand what is happening.

What Do Days on Market Tell Us?

A longer than normal DOM is an indication that a property is having a hard time selling. This may be caused for multiple reasons including the home being listed too high, not being shown aggressively by the agent, or the home could be in a bad location or be in bad condition. However, in the end, it is a pricing issue because most anything will sell if it is priced accurately and to the market.

When looked at along with other stats, DOM can help to verify whether the market is appreciating or not. For example, if a home is under contract for a higher than typical price and overall prices are slowly trending upward, the sale price to list price ratio is increasing, and the DOM is decreasing, this data may help provide support for a positive adjustment.

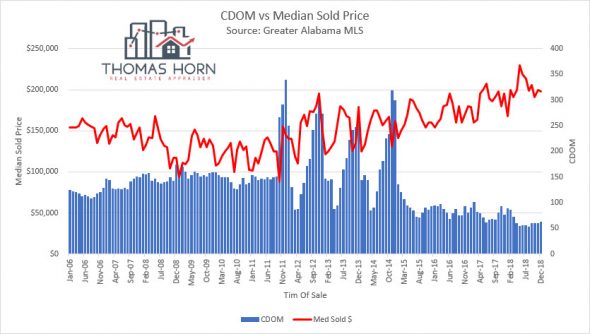

The graph below shows the relationship between CDOM and Median Prices. As you can see lower Days on Market is usually an indicator that the market is doing well and when it is prices tend to increase.

Four Ways Buyers And Seller Can Use Days On Market

1) Remember that real estate is always local. Don’t use national statistics to price your listings but instead use local data. Find out what the DOM trend is for the market area you are working in. If DOM is trending downward then you can generally be more aggressive in your pricing if all of the other indicators are positive.

2) If other properties that have sold or that are currently listed for sale have a higher than normal DOM then you know that the market may be soft. In a situation like this, it may be wise to price lower to help move the property faster.

3) For buyers, if you are interested in a home and the DOM exceeds what is typical for the area then that may indicate that it is priced too high. If the seller is not willing to reduce their price then you may want to keep looking.

4) If a sellers home has been on the market within the typical DOM for the area and the home has had multiple price reductions then they may be motivated to sell and you may have a better chance at negotiating the price down.

Knowing the Days on Market for your area can help you sell your home quicker and for a fair price or it can help in negotiating a better price if you are buying.

Conclusion

I hope that knowing a little more about Days on Market can help you when either buying or selling a home. If you have any other questions feel free to contact me and as always, thanks for reading.

Nice job Tom. In my mind CDOM is the real stat because it speaks to how much time a property has really been on the market. I noticed in your graph that CDOM seems to have shot up in 2011 as values were rising. I would think it would take less time to sell. That’s really interesting to see the market have four years of this dynamic only to show a declining trend for CDOM in subsequent years.

Yeah, I noticed that too, Ryan. I don’t know if it was a glitch in the data that was reported but there was definitely a trend for a couple of years. I noticed the same behavior in some other data well. I need to dig into that to see what is behind it.