What qualitative analysis is and how agents can use it to price their listings

If I were to pick one question that I get asked the most as an appraiser by real estate agents it would be regarding how much a certain feature of a home is worth. In other words they want to know what the “adjustment” for the feature is, which can be used during their CMA’s in pricing their listings.

feature of a home is worth. In other words they want to know what the “adjustment” for the feature is, which can be used during their CMA’s in pricing their listings.

My appraiser friend Ryan Lundquist, who works in the Sacramento, CA area, recently wrote an excellent article about why a little black book of adjustment values does not exist. The main reason that one adjustment value for each feature does not exist is that adjustment values are tied to specific neighborhoods and price ranges. As appraisers our job is to analyze a market and determine what each adjustment is, however because real estate agents are not experienced in using the necessary techniques to do this they must use another method to do the same thing. Making dollar adjustments is an example of a quantitative technique, however there is another method that may be more appropriate that real estate agents can use. Today I would like to discuss what qualitative analysis is and how agents can use it to price their listings.

What is qualitative analysis?

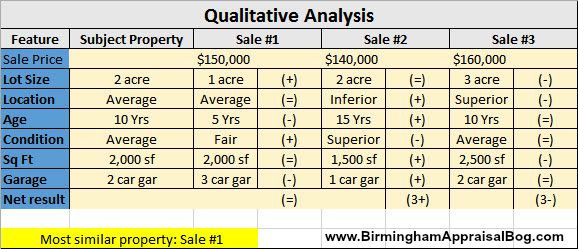

Qualitative analysis involves using quality ratings based on how the sales compare to the subject property. An example of this would go something like this: If a sale is better than the subject property in a certain feature then rather than making a downward dollar adjustment you would just add a negative (-) sign next to the feature. You would continue to do this for each feature that you have found has meaning to buyers.

Real estate agents have a unique insight into the perceived importance of various features since they talk to buyers all the time. Agents can use this to their advantage by making note of what the majority of people find important, even taking note of various buyer profiles in different market areas. This is important because buyers in certain locations and in certain price ranges may value things differently than that of other areas and price ranges. So you may add a positive (+) sign in one neighborhood but then in another that same feature may be negative (-). I’ve included an example of what a qualitative analysis might look like below.

After you have added either a positive or a negative sign next to significant features you would then tally them up and note the net result. If you had 5 positive signs, and 3 negative signs, the end result would be 2 positives. By doing this for each sale analyzed you will get a better understanding of how similar each sale is to the subject property.

The example I have included is simplified, however it will give you a good idea of what I am explaining. As you can see, sales #2 and #3 are equally different from the subject with sale #2 being inferior to the subject , which require a positive adjustment, while sale #3 is superior to the subject requiring a negative adjustment. Sale #1 is the most similar to the subject because the signs cancel each other out, therefore you would place the most emphasis on it. There will be instances where the positive and negative adjustments don’t work out as nice as they did here but at those times you would reconcile the sales, placing the most emphasis on the sales requiring the least overall adjustments.

This method follows steps similar to what an appraiser would take, however it does not require using dollar adjustments. It does help you to visualize which sales should be given more emphasis using your knowledge of what features are the most important to buyers in the market you are working in. I have only included a brief description of qualitative analysis here but if you would like to discuss this method in more detail feel free to contact me.

Question

Does this method of coming up with a list price make sense? If you’d like to add a comment and give me your thoughts I’d love to hear from you , so feel free to leave a comment below. As always, thanks for reading and commenting.

If you liked this post subscribe by email (or RSS feed). Thanks for visiting.

Great post. One thing I would like to add is that another way to do a qualitative analysis is to simplify it and just rank or arrange the sales (ranking analysis) from lowest price to highest price and rate them as overall much inferior, inferior, similar, superior, and much superior. The problem that I find with the plus and minus (although it is helpful in organizing thoughts), is that a plus for one factor does not always equal a plus for another factor. In other words, one comparable with three plus signs might mislead the reader to think that it is equal to another comparable with three plus signs.

Thanks for sharing your thoughts Gary and adding another perspective on qualitative analysis. Any way that an agent can mimic the process an appraiser goes through to come up with a market supported list price is a step in the right direction. I just want them to know that they can do this without needing to know adjustment amounts. I appreciate your input.

Great article, Tom. I’m glad to see more appraisers recognize that there are no “magical” adjustment amounts, particularly in markets or value ranges where data is sparse. The qualitative analysis better mimics the actual thought processes of buyers and sellers, and isn’t that what we are supposed to do as well? Thanks.

Thanks Leigh Ann. Yes, I agree that we are suppose to be measuring the thought processes of buyers and sellers. I appreciate your insight.

Thanks for the shout-out to my article, Tom. I appreciate it. I like how you are showing agents to think about making adjustments. Sometimes of course the best adjustment is no adjustment. Sometimes our initial reaction is to give an adjustment every time we see a difference, but we have to ask, what is the market willing to pay? Is there a real difference between that house on 2 acres and 2.5 acres or 4 acres and 5 acres?

Agreed Ryan. That is why I suggest that agents take note of buyer preferences in the different markets they cover. I think they have a lot of information at their fingertips that they may not even think about. When they interact with buyers on a daily basis they can get a very good idea of what features are important to them and this information should be used when deciding if a feature deserves consideration when pricing their listings.