Whenever anyone asks me how the real estate market is doing in the Birmingham, AL area I am quick to point out that while there is still a long way to go before we get back to the glory days we do have some good things happening. Up until about 12 months ago, whenever I did an appraisal I couldn’t complete one without needing to include some foreclosure sales. It’s not because I wanted to but because it was necessary since they were such a large part of the total sales that had occurred. In other words they were driving the market not only in closed sales but also homes that were actively listed for sale.

Part of the appraisal process is not only reporting on sales that have recently closed but also looking at what is available for sale. This is especially relevant for pre-listing appraisals because these active listings are establishing an inventory of possible properties that potential buyers have to choose from compared to the home I am appraising in order to set a list price. The final opinion that I arrive at must consider what has recently sold, but it also must be priced such that it competes well with other properties that are available for sale. There has been a significant reduction in foreclosure sales over the past several years as you can see in the following graph:

Over the years Birmingham has a experienced a very stable real estate market and we did not have the extreme appreciation like other areas, but we also did not fall as low as many other areas did when the real estate market crashed. Back in 2010 the Wall State Journal was predicting that the country had about 9 years worth of shadow inventory which includes all the homes that are currently in foreclosure and that are delinquent and will probably go into foreclosure, and which have not yet been put on the market for sale. Needless to say this number has decreased significantly along with total foreclosure rates. The local area is also following this same trend as the graph above shows.

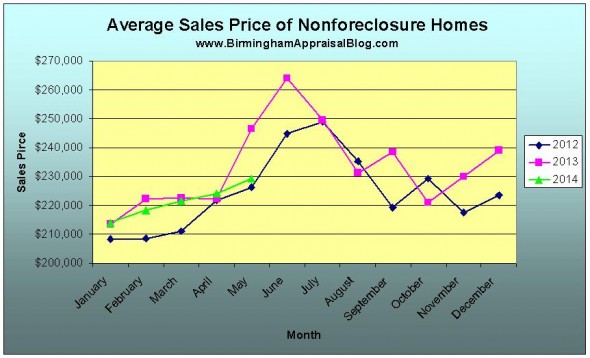

The reduction of foreclosure sales and listings has had a positive impact on the average price of homes in the Birmingham, AL area. Take a look at the average sale price of a non foreclosure home:

In 2013 almost every month had an increase in the average sale price. The prices in 2014 are not as dramatic but it looks like the overall trend is positive. From an appraisal standpoint this is good because these distress sales do not have to be considered as much as they were several years ago. We now see the majority of sales and active listings being non foreclosure “normal” properties. Don’t misunderstand me and think that this is true in every area because it is not. There are some neighborhoods where foreclosure activity is still occurring but the overall trend is getting better. Another positive trend in these distressed areas is the willingness of investors to take a chance and purchase these foreclosures, renovate the homes, and resell them. These “flippers” are finding that they can make a profit on these homes and still sell them for a competitive price. The resale of these foreclosures is slowly helping the neighborhoods recover, however as I said previously it will take a while before we get back to where we were at the height of the market.

How are foreclosures in your area, and are you seeing a reduction as we are in Birmingham? Drop me a line and let me know what’s happening where you live.

If you found value in this post or in my blog you can subscribe by email or RSS feed. If you think others would find it helpful, please consider sharing it. Thanks for visiting.

Speak Your Mind