How do appraisers make adjustments?

During a recent talk at a local real estate agents office I was asked a question about how do appraisers make adjustments. As a follow up they also wanted to know if these adjustments would be available to them to help in pricing their homes. This is a very good question and one that I have heard asked often over the years so I thought I would share my thoughts on this with you.

also wanted to know if these adjustments would be available to them to help in pricing their homes. This is a very good question and one that I have heard asked often over the years so I thought I would share my thoughts on this with you.

There is a misconception that there is one master list of appraisal adjustments that work for every appraisal, however this master list does not exist because every property is different. As you well know location is paramount in property values and each location will require a different adjustment based on what the market will pay for a particular feature. The appraisers job is to analyze the market and determine what the appropriate adjustment is for the property. There are several methods that appraisers use so lets take a look at them and house they are used.

Methods Appraisers Use To Adjustments

There are several methods I’ll share with you here and they include the Sales Comparison-Paired Data Analysis, Income Capitalization Approach, Cost Less Depreciation, and Buyer Interviews.

Sales Comparison-Paired Data Analysis

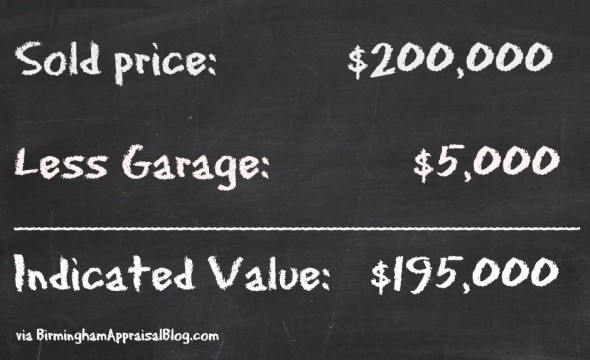

The sales comparison and paired data analysis is the easiest to do IF you have appropriate comparable sales. The idea behind this method is that you find two different sales that are alike in all features except for one. The sales prices are analyzed to determine the difference in price attributed to this one feature and then you determine if the feature is beneficial or detrimental. For example, if two homes sold, one for $150,000 and the other for $155,000, and the only difference was that the one that sold for $155,000 had a one car garage, you would then determine that this feature was beneficial, meaning that the house sold for more because it had a garage and the amount of the adjustment would be $5,000.

You can take this approach one step further by using additional sales to extract and support adjustments when there is more than one difference. After you find the adjustment amount for the first feature and adjust for it you can isolate the value difference for the secondary feature. The real estate market is not perfect because you have people acting on their likes, dislikes and emotions. If it were a perfect market all of the sales would have a similar adjusted sales price, however this is not the case and there are variations that the appraiser must reconcile when reporting their final opinion of value.

Income Capitalization Approach

This approach is based on the premise that differences in property features are reflected in the amount of rent that you can get for the property. It consists of collecting similar home sales, then adjusting for differences that affect the sale price but not the rental rate. After you have a cash equivalent value you determine the gross rent multiplier (GRM) by dividing the adjusted sale price by the monthly rental amount.

After calculating a GRM you then determine the rental difference that a feature causes. An example might be a three bedroom home compared to a four bedroom home. If the four bedroom home rents for $100 more per month than the three bedroom home, and the GRM is 105, the adjustments amount would be $100 x 105 = $10,500. This method is best used for properties in a market where there is numerous and reliable rental data.

Cost Less Depreciation

This method utilizes construction costs as well as depreciation estimates, which is value that is lost due to wear and tear on the component. This approach is usually the quickest and easiest to use because appraisers are very familiar with cost figures. It consists of calculating the cost of a feature and then deducting the depreciation from it to arrive at the depreciated value of the item. It is very important to be able to estimate every form of depreciation so that the adjustment is as accurate as possible. This approach would be handy when there is not enough sales data to do a matched pair analysis.

Buyer Interviews

The last way an appraiser can come up with adjustment amounts is by interviewing buyers. When buyers are going through negotiations while buying a house they usually place varying degrees of value on different features. By speaking with the buyers and asking them how much value they placed on a feature we can develop an estimate of the features contributory value. This can vary between buyers depending on how they feel about the feature.

Conclusion

These are the various ways to come up with adjustment amounts and it will depend on the market you are in as to what method is the best to use. Appraising is not an exact science so adjustment amounts can vary, and as you can see there cannot be one book of adjustments that fit every house.

Do you have any questions about why appraisers do what they do, or how they do it? Leave me a message below and I’ll be sure to answer it for you.

If you liked this post subscribe by email (or RSS feed). Thanks for visiting.

Tom, wish I knew about you years ago. Question and I am sure you have heard this one before, “what happens if there are no real comps in your area? Do you just keep expanding the size of the market to find some?”

Great question, Dave. Yes, that is exactly what I do. I start my comp search with the subject’s immediate area and expand parameters if I cannot find comps. I always try to look within the competitive market area which includes all areas that a potential buyer would consider. This would include the same or similar school systems, etc. If there are any differences in location then you would need to adjust for that too.

Hi Tom, thanks for the info. I was most interested in how and if there is a best way to make the sf adjustment? Paired sales if possible? Lump sum high and low sale price, sf gross living area difference? A market driven adj. ? Any input from anyone is helpful

I think that any adjustment you make needs to be market driven as that is going to reflect the markets reaction to different amounts of square footage or features. The amount and quality of information will determine which method is best to use. If you have good data to do a matched pairs then I would use that but a lot of times that is not the case. If you do not have enough data in the subdivision you are working in then you might want to include other comparable subdivisions that have similar quality and price range homes. Using Excel to analyze MLS sales data can also help you to come up with adjustment amounts. If you have not taken the Appraisal Institute class called “Valuation by Comparison: Residential Analysis and Logic” I highly recommend it because it covers the various ways to support adjustments. Hope this helps.

Tom

I am a Realtor in Indiana and am interested in attending some appraisal classes. Who should I contact ?

Thank you !

Bev, I would check with the state appraisers board to see what approved education providers and classes they have. I looked up their website which I am sending you. Let me know if you have any other questons. State of Indiana appraisers website: http://www.in.gov/pla/appraiser.htm

Well said, Tom. There is indeed no little book of value that lists all the adjustments. This is a key concept for real estate, and ultimately it reminds us how sensitive real estate is to the local market. An adjustment in one neighborhood could be different than an adjustment in a nearby neighborhood.

That’s exactly true Ryan. Thanks for explaining it so concisely.

Great topic Tom. I get this question from agents as well. I usually also talk about statistics when I answer this question, but statistics are just using many paired sales, rather than just one pair.

Great point Gary. I know you use statistics a great deal in your practice, and I think that as we move into the future this will be standard for all appraisers since we have access to so many tools to analyze the data.

Very good primer for non-appraisers Tom. Agents would be doing themselves a favor by taking some basic appraisal courses from the Institute. Or, they could hire a professional appraiser to do a pre-listing appraisal when they list a home.

I liken the adjustment process to reverse engineering. You look at the overall market, identify the elements of contribution within that market, determine the value the elements of contribution, and then apply the value of the elements of contribution to the subject property. It’s not magic and often times it takes a lot of work to determine the value contribution of individual items. But that is the job of the appraiser. And that is why they pay us the big bucks (lol ).

I agree Tom, it would benefit agents to have some appraisal classes. Whenever I speak to agents office I try to give them a mini course in appraising so they have some basic understanding. It seems to go over well with them and they always seem to be eager to learn. I think in the past that an area of weakness for appraisers has been public relations with agents and speaking at offices bridges this gap.