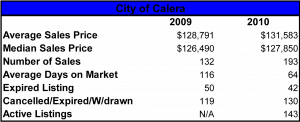

Calera is a quaint town is Shelby County, Alabama. As an appraiser I have seen Calera go through some rough times in the past 18 months. It was a growing community prior to the recent real estate collapse with numerous garden home developments being built and doing quite well. However, within the past 18 months, growth came to a near complete stand still. Many subdivisions, which had just broke ground, sat undeveloped with roads and infrastructure in place but no demand to speak of. It appears demand may be returning. Some new construction is beginning to start up again and sales statistics taken from the local Birmingham Association of Realtors indicates that prices may be starting to inch back up from last year. From the information below you can see that both median and average sales prices are increasing, average days on market is decreasing, and sales are increasing. These statistics reflect garden homes built between 2005-2010. Other types and age of homes may reflect different characteristics.

Calera is a quaint town is Shelby County, Alabama. As an appraiser I have seen Calera go through some rough times in the past 18 months. It was a growing community prior to the recent real estate collapse with numerous garden home developments being built and doing quite well. However, within the past 18 months, growth came to a near complete stand still. Many subdivisions, which had just broke ground, sat undeveloped with roads and infrastructure in place but no demand to speak of. It appears demand may be returning. Some new construction is beginning to start up again and sales statistics taken from the local Birmingham Association of Realtors indicates that prices may be starting to inch back up from last year. From the information below you can see that both median and average sales prices are increasing, average days on market is decreasing, and sales are increasing. These statistics reflect garden homes built between 2005-2010. Other types and age of homes may reflect different characteristics.

Listings that were either cancelled, withdrawn, or expired has stayed relatively stable. The first time homebuyer tax credit may have affected the statistics. This may be the beginning of a rebound, only time will tell. Have you seen this type of activity in your market? Is there any new construction activity occurring?

I forgot to mention new construction. New home construction in my market, in the right more affordable price ranges, never stopped and has pushed forward. “Economy builders” are buying up lots in once higher end developments that stalled and finishing them out with lower priced housing. This makes those that bought in early up-side down and some are selling for a loss to get out. The primary economy builder in my market purchased over $10,000,000 in vacant lots in 2009 for 2010 building. New construction under $195K and especially in the $140K to $150K is selling lot hot cakes around here, in multiple local markets. They’re taking a little longer to sell in later 2010, but they are the main new home sales in my market.

Meanwhile, those builders that commanded the $136/sf to $180/sf in 2006 to 2008 are sitting there twiddling their thumbs asking, “When is the housing market coming back?”. I have news for them….it’s not coming back. Locals, in bulk, cant’ afford to pay $138/sf to $180/sf for new homes, not with the increase in property taxes, cost of living, etc.. Heck, they have the wife working and the dogs mowing lawns just to make the house payments around here. And, it’s a joke to think that locals are going to pay a 15% to 25% premium for green housing! Ain’t going to happen anytime soon around here. What’s selling around here in terms of new construction is the New Market between $140K to $200K, in bulk.

Bill

Hey Bill, I did notice the new home construction in certain areas was really basic home construction. The smart builders are the ones that are adapting and reacting to what the market wants, or can afford. I am with you on the green construction. This needs to be dictated by the demand for this type of construction in the market and not propped up by the government or else it will fail.

I totally agree with you!!! So far, local green homes have been subsidized by the Federal Government and in my opinion as a tax payer, that’s not a good sign. The U.S. Federal Government is in no financial position to take this on.

Your comments above are stirring a blog post within my mind. I need to make a trip down to Albany La and take some photos of some green housing for an article. Thank you so much! Bill

I am sure that those people thinking about building a green home would like to know if the financial investment is worth it. I think that would be a great topic for a blog post.

Wow! Then your market up to this point appears to be doing well, better than in 2009.

The first thing I noticed was that you had 61 more sales in 2010 than in 2009, which is totally opposite my market. My market in 2010 is at 50% of home sales in 2009. So, consider yourself blessed.

Second thing was your DOM is 52 days lower, another positive.

Third, your current active listings @ 143 are still below 193 total sales in 2010, which is another positive.

I hope that this all wasn’t just the result of the tax credit rush sales and that this market hasn’t softened much since the expiration of the tax credit?

Congrats!!! This was an excellent market update. I hadn’t thought about reporting on expired or cancelled/withdrawn listings but will consider it on the next update.

Bill Cobb

Right Bill, while not stellar, there are a lot of positive indicators. Hopefully this will continue!

The median sales price doesn’t look like it took too much of a nose-drive from 2009 to 2010. Is that a good sign for your area or is there other data to consider that shows the true nature of the market? I find that median price alone does not always indicate the health of the market. Good post.

You are right Ryan, there was not a big difference in the median sales price. While the numbers do not show a big increase they are at least not going down. In addition to that, there are new homes being built. That says a lot considering the large inventory of existing new construction which has been on the market awhile. Seems like some builders are offering homes with a minimum of bells and whistles (or none at all), so they can offer them at a price that will compete with the previously mentioned inventory of new homes. Seems like it is hard to predict too far into the future as things can and do change from day to day.